As sustainability regulations evolve globally, procurement teams must adapt their supplier engagement strategies to meet new ESG disclosure requirements.

ESG reporting has moved from peripheral concern to central business requirement with remarkable speed. What began as voluntary disclosure for sustainability-minded organisations has become mandatory reporting for many and expected practice for most. For procurement teams, this shift has particular implications: supply chain ESG performance increasingly features in organisational reporting, and the data needed to support that reporting has to come from somewhere.

Understanding where ESG reporting requirements are heading—and preparing supplier management processes accordingly—positions procurement teams to meet emerging demands rather than scrambling to catch up.

The Regulatory Landscape

The UK's regulatory framework for ESG reporting continues to evolve. The Streamlined Energy and Carbon Reporting (SECR) requirements already mandate energy and carbon disclosure for large companies. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations have become mandatory for many listed companies and large private businesses. The Modern Slavery Act requires annual statements from organisations above the turnover threshold.

Looking ahead, the UK has signalled intentions to implement sustainability disclosure standards aligned with international frameworks. The International Sustainability Standards Board (ISSB) standards, while not yet UK law, indicate the direction of travel—more comprehensive, more standardised, and more demanding than current requirements.

Public sector procurement adds another layer. PPN 06/21 requires carbon reduction plans from major government suppliers. Social value considerations under PPN 06/20 encompass environmental and social factors. Forthcoming procurement legislation is expected to strengthen these requirements further.

Scope 3: The Supply Chain Challenge

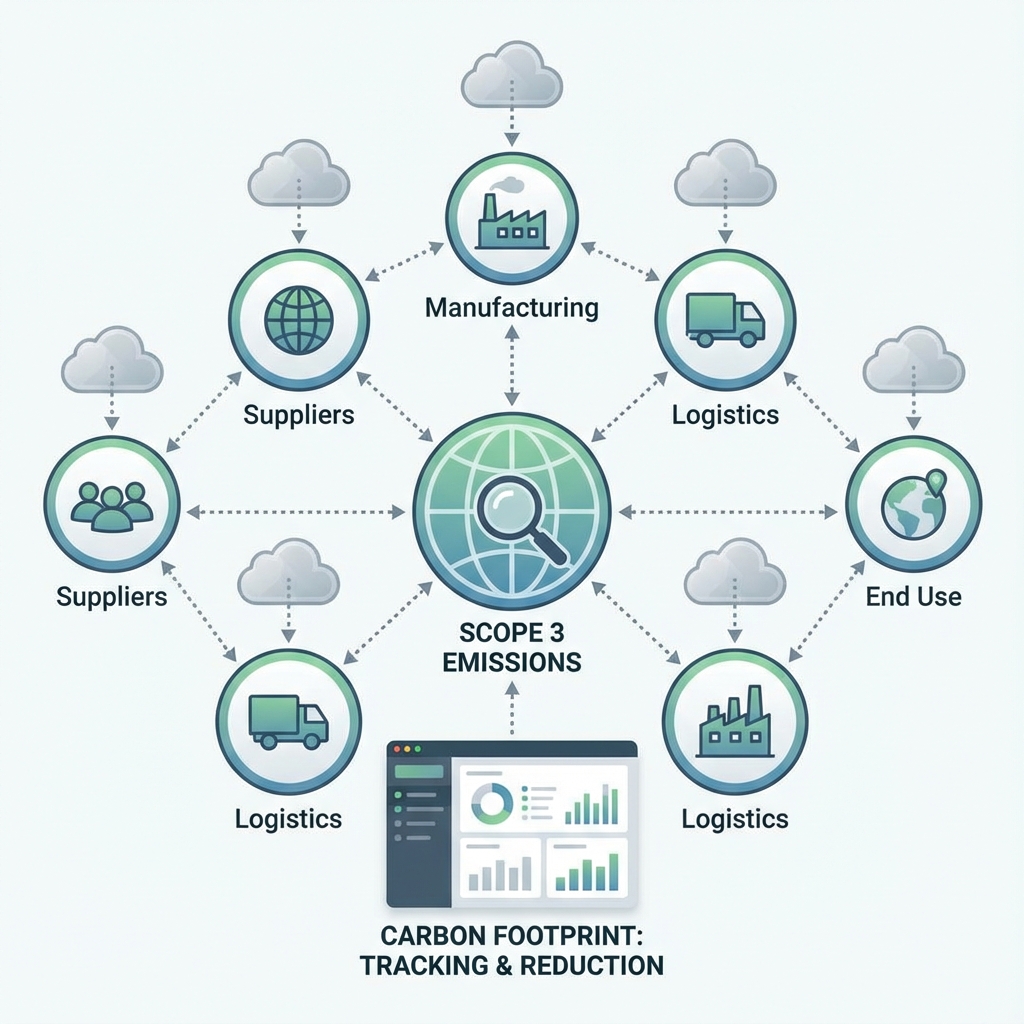

The most significant shift in carbon reporting is the increasing focus on Scope 3 emissions—those occurring in an organisation's value chain rather than its direct operations. For most companies, particularly in service sectors, Scope 3 emissions dwarf Scope 1 and 2 combined. Meaningful carbon reduction requires addressing supply chain emissions, not just operational ones.

This creates immediate challenges for procurement teams. Reporting Scope 3 emissions requires data from suppliers—emissions figures, energy consumption, transport and logistics information. Many suppliers, particularly smaller ones, don't track this data themselves. Methodologies for estimation vary, making comparability difficult. The sheer volume of supplier relationships makes comprehensive data collection seem overwhelming.

Organisations are responding with varying approaches. Some focus on high-impact categories and major suppliers, accepting that full coverage isn't immediately achievable. Others use spend-based estimation models that approximate emissions from procurement expenditure patterns. The most sophisticated are building supplier engagement programmes that help suppliers measure and improve their own emissions while providing data for customer reporting.

Beyond Carbon: The Broader ESG Agenda

While carbon dominates current attention, ESG reporting spans a much broader territory. Environmental factors include water usage, waste management, biodiversity impacts, and pollution. Social considerations encompass labour practices, human rights, health and safety, diversity and inclusion, and community impacts. Governance covers ethics, anti-corruption, data protection, and corporate behaviour.

Supply chain relevance varies across these dimensions. Labour practices and human rights have obvious supply chain implications—organisations are increasingly held responsible for conditions in their suppliers' operations. Environmental impacts extend through supply chains as surely as carbon emissions. Governance standards in suppliers affect the integrity of the products and services they provide.

Reporting frameworks increasingly require supply chain disclosure across these dimensions. The Corporate Sustainability Reporting Directive (CSRD), while EU legislation, affects UK organisations with EU operations or significant EU revenue. The UN Sustainable Development Goals provide a framework that many organisations use to structure broader ESG reporting. Industry-specific standards add additional requirements in sectors from financial services to construction.

What This Means for Procurement

For procurement teams, these trends translate into concrete operational requirements. Supplier data collection needs to expand beyond traditional commercial and compliance information to include ESG metrics. Supplier assessment criteria need to incorporate ESG factors in evaluation and selection. Contract terms need to address ESG requirements, performance expectations, and data provision obligations.

Perhaps most significantly, procurement teams need to engage suppliers as partners in ESG improvement rather than merely demanding data. Many suppliers lack the capabilities, resources, or expertise to measure their ESG performance effectively. Organisations that help suppliers build these capabilities—through guidance, tools, training, or collaborative programmes—generally achieve better results than those that simply impose requirements.

This engagement role represents a significant evolution in procurement's traditional function. Beyond securing goods and services at appropriate commercial terms, procurement becomes a channel for extending organisational ESG standards into supply chains. This requires different skills, different conversations, and different success metrics than traditional procurement activities.

Technology and Data Management

Managing ESG data across supplier bases of any significant size requires systematic approaches that manual processes cannot sustain. Supplier portals that collect ESG information alongside standard compliance documentation. Databases that store, track, and report supplier ESG performance over time. Analytics that identify patterns, highlight risks, and measure progress against targets.

Integration matters. ESG data that sits in separate systems from supplier commercial and compliance information creates fragmentation and reduces usefulness. When ESG metrics are visible alongside other supplier performance indicators, they become part of routine supplier management rather than a separate reporting exercise.

Standardisation also helps. Asking every supplier for different information in different formats creates aggregation nightmares. Adopting recognised frameworks—CDP for carbon, EcoVadis for broader ESG, industry-specific standards where they exist—enables comparability and reduces supplier burden where they report to multiple customers using the same frameworks.

Preparing for What's Coming

Organisations that build supplier ESG capabilities now position themselves for requirements that haven't yet crystallised. The direction of travel is clear: more comprehensive disclosure requirements, greater supply chain accountability, higher stakeholder expectations. Starting early creates competitive advantage and avoids the scramble when requirements become mandatory.

Practical preparation includes: identifying which suppliers are most material to your ESG footprint and prioritising engagement with them; establishing data collection mechanisms that can scale as requirements expand; building internal capabilities to analyse and act on supplier ESG data; engaging suppliers collaboratively on improvement rather than merely collecting data for reporting.

The organisations that will navigate ESG reporting evolution most successfully are those that treat it not as a compliance burden but as an opportunity—to understand their supply chains better, to build more resilient supplier relationships, and to contribute genuinely to sustainability outcomes rather than merely reporting on them.